Mortgage

rates dipped for the second consecutive week, with the most popular loans

falling to their lowest marks since late November.

The 30-year fixed-rate average sank for the fourth consecutive week and is

now at 4.39 percent, a decline of 0.02 percentage point week-over-week,

according to the latest survey

from mortgage buyer Freddie Mac. The popular loan averaged 4.53 percent at the

start of 2014 and was at 3.53 percent a year ago.

The 15-year fixed-rate average also declined, falling to 3.44 percent from

3.45 percent. It has fallen in each of the last three weeks and is now at its

lowest point since the last week of November. A year ago, the 15-year rate

averaged 2.81 percent — a difference of .63 percentage point year-over-year.

Averages for hybrid adjustable rate mortgages were mixed. Previously at 3.1

percent, the five-year ARM increased by 0.05 percentage point to 3.15 percent

this week. After holding steady at 2.56 percent for one month, the one-year ARM

saw a slight dip this week, falling 0.02 percentage point to 2.54 percent.

“Mortgage rates were flat to down a little this week amid reports that

inflation remains subdued,” Frank Nothaft, Freddie vice president and chief

economist, said in a statement. “The Consumer Price Index was up 0.3 percent in

December after being unchanged in November. For the year as a whole, consumer

prices rose just 1.5 percent in 2013.”

Mortgage rates had been rising steadily in December after the Federal Reserve

announced it would begin to curb its bond-buying stimulus program in January.

The bond-purchase program has helped offset dramatic gains in real estate prices

and kept affordability elevated while the market has stabilized.

While home sales have slowed since the Fed’s announcement, the rebounding

housing market continues to show signs of recovery. As the recovery progresses,

key rates are expected to see a significant rise. In the short-term, however,

rates are expected to hold steady.

In the latest Mortgage

Rate Trend Index by Bankrate.com, the majority of loan experts polled

believe that rates will remain relatively unchanged over the next week.

“If the Fed announces a continued tapering at next week’s meeting, that gives

a vote of confidence in the economy that will eventually push mortgage rates

higher,” opined Greg McBride, senior financial analyst for Bankrate.com. “But

it’s wait-and-see mode in the meantime.”

Excerpted from original article found here.

Rahul and Smitha Ramchandani are a licensed real estate

Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey.

They are Buyer Specialists and Home Marketing Experts. You can reach Rahul and

Smitha and their team online at: http://www.Morris-Homes.com, http://www.SRRealEstateGroup.com

and http://www.TheTownhouseExpert.com

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Madison,Chester,Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown,Morris Plains,Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany.

What's happening in the Morris, Essex, Somerset and Union County New Jersey Real Estate Markets. North NJ Real Estate Specialists. Real Estate Sales and News in Morristown, Morris Twp, Denville, Parsippany, Montville, Hanover, East Hanover, Randolph, Mountain Lakes, Whippany, Madison, Chatham, Basking Ridge, Short Hills, Summit, New Providence, Livingston, Roseland and more.

Thursday, January 23, 2014

Report: Exterior Remodeling Offers Largest Return on Investment

If you’re looking to do some home improvement projects this year, sprucing up

the outside of your home is going to give you the biggest bang for your buck,

according to the 2014

Remodeling Cost vs. Value report released this month.

The report, an annual collaboration between Remodeling magazine and REALTOR® Magazine, compares the average cost for 35 popular remodeling projects with the value those projects retain at resale in 101 U.S. cities.

Eight of the top 10 most cost-effective projects nationally, in terms of value recouped, are exterior projects.

“With many factors to consider such as cost and time, deciding what remodeling projects to undertake can be a difficult decision for homeowners,” said National Association of REALTORS® President Steve Brown, co-owner of Irongate, Inc., REALTORS® in Dayton, Ohio. “REALTORS® know what home features are important to buyers in their area, but a home’s curb appeal is always critical since it’s the first impression for potential buyers.”

A steel entry door replacement was deemed the project expected to have the biggest return on investment, with an estimated 96.6 percent of costs recouped upon resale. This particular remodel project is consistently the least expensive in the annual Cost vs. Value Report, at around $1,100 on average.

Excited to dive in? Here are the top 10 cost-effective improvements from this year’s report:

1. Replace Your Front Door: 97% ROI

2. Add a Deck or Patio: 87% ROI

3. Add Space/Attic Bedroom: 84% ROI

4. Replace Your Garage Door: 83% ROI

5. Remodel Your Kitchen: 82% ROI on a minor remodel; 74% ROI on a major remodel

6. Replace Your Windows: 79% ROI

7. Replace Your Siding: 78% ROI for replace vinyl siding; 87% ROI to replace siding with a fiber-cement mix

8. Basement Remodel: 78% ROI

9. Update Your Bathroom: 73% ROI

10. Two-Story Addition: 72% ROI

Original article found here.

Rahul and Smitha Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and Home Marketing Experts. You can reach Rahul and Smitha and their team online at: http://www.Morris-Homes.com, http://www.SRRealEstateGroup.com and http://www.TheTownhouseExpert.com

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Madison,Chester,Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown,Morris Plains,Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany.

The report, an annual collaboration between Remodeling magazine and REALTOR® Magazine, compares the average cost for 35 popular remodeling projects with the value those projects retain at resale in 101 U.S. cities.

Eight of the top 10 most cost-effective projects nationally, in terms of value recouped, are exterior projects.

“With many factors to consider such as cost and time, deciding what remodeling projects to undertake can be a difficult decision for homeowners,” said National Association of REALTORS® President Steve Brown, co-owner of Irongate, Inc., REALTORS® in Dayton, Ohio. “REALTORS® know what home features are important to buyers in their area, but a home’s curb appeal is always critical since it’s the first impression for potential buyers.”

A steel entry door replacement was deemed the project expected to have the biggest return on investment, with an estimated 96.6 percent of costs recouped upon resale. This particular remodel project is consistently the least expensive in the annual Cost vs. Value Report, at around $1,100 on average.

Excited to dive in? Here are the top 10 cost-effective improvements from this year’s report:

1. Replace Your Front Door: 97% ROI

2. Add a Deck or Patio: 87% ROI

3. Add Space/Attic Bedroom: 84% ROI

4. Replace Your Garage Door: 83% ROI

5. Remodel Your Kitchen: 82% ROI on a minor remodel; 74% ROI on a major remodel

6. Replace Your Windows: 79% ROI

7. Replace Your Siding: 78% ROI for replace vinyl siding; 87% ROI to replace siding with a fiber-cement mix

8. Basement Remodel: 78% ROI

9. Update Your Bathroom: 73% ROI

10. Two-Story Addition: 72% ROI

Original article found here.

Rahul and Smitha Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and Home Marketing Experts. You can reach Rahul and Smitha and their team online at: http://www.Morris-Homes.com, http://www.SRRealEstateGroup.com and http://www.TheTownhouseExpert.com

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Madison,Chester,Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown,Morris Plains,Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany.

This Month in Real Estate - January

Check out what’s happening this month in real estate!

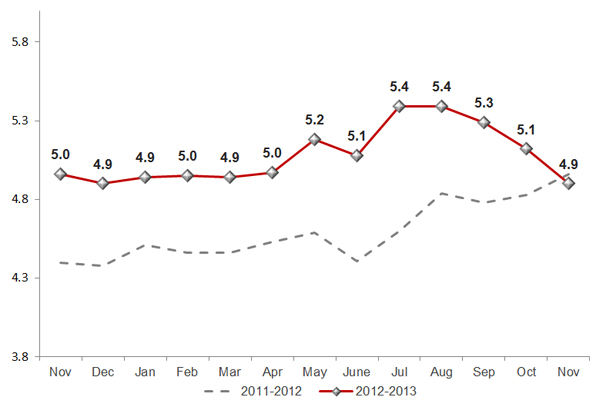

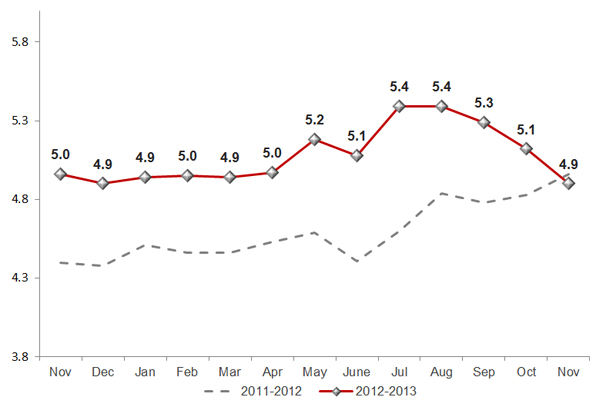

Median home prices dipped slightly from October to November, dropping 0.6% from $197,500 to $196,300 according to NAR. Year-over-year home prices continue to post significant gains with prices up 9.4% from last November. However, November is the first month since the same month of the previous year to have a year-over-year gain of less than 10%.

According to the National Association of Realtors, the seasonally adjusted rate of home sales declined 4.3% from last year to an annual rate of 4.9 million homes. The rate of home sales is down 1.2% from the rate reported in November of last year; however, the decline in the portion of sales made up of distressed properties, from 22% last year to 14% this year, means we likely are still seeing positive year-over-year gains in conventional home sales. As banks begin to implement new lending regulations, credit tightness is likely hampering home sales and may continue to do so in the beginning of the New Year.

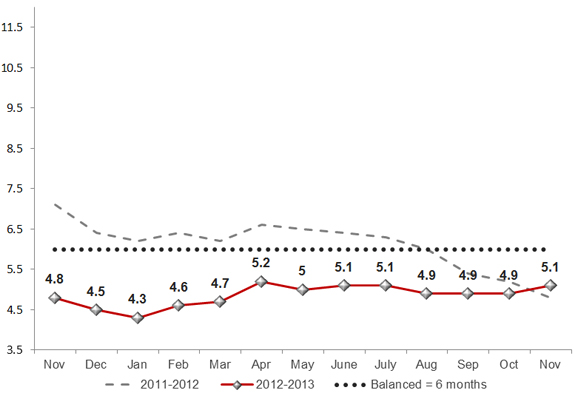

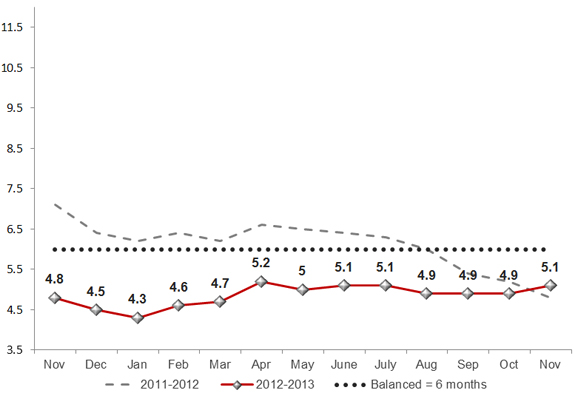

The level of total housing inventory in the country dropped in November to 2.09 million homes, down 1.9% from the previous month. Month of supply of inventory, however, ticked up slightly due to the lower pace of sales this month. The number of months of supply represents how many months it would take the current level of inventory to sell given the current sales pace if no other homes were added to the market. Supply in October represented 5.1 months, up 4.1% from the previous month, and up 6.3% from November of the previous year.

The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed on This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Rahul and Smitha Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and Home Marketing Experts. You can reach Rahul and Smitha and their team online at: http://www.Morris-Homes.com, http://www.SRRealEstateGroup.com and http://www.TheTownhouseExpert.com

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Madison,Chester,Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown,Morris Plains,Morris Twp., Mountain Lakes, Parsippany,Randolph, Rockaway, Whippany.

Median home prices dipped slightly from October to November, dropping 0.6% from $197,500 to $196,300 according to NAR. Year-over-year home prices continue to post significant gains with prices up 9.4% from last November. However, November is the first month since the same month of the previous year to have a year-over-year gain of less than 10%.

According to the National Association of Realtors, the seasonally adjusted rate of home sales declined 4.3% from last year to an annual rate of 4.9 million homes. The rate of home sales is down 1.2% from the rate reported in November of last year; however, the decline in the portion of sales made up of distressed properties, from 22% last year to 14% this year, means we likely are still seeing positive year-over-year gains in conventional home sales. As banks begin to implement new lending regulations, credit tightness is likely hampering home sales and may continue to do so in the beginning of the New Year.

The level of total housing inventory in the country dropped in November to 2.09 million homes, down 1.9% from the previous month. Month of supply of inventory, however, ticked up slightly due to the lower pace of sales this month. The number of months of supply represents how many months it would take the current level of inventory to sell given the current sales pace if no other homes were added to the market. Supply in October represented 5.1 months, up 4.1% from the previous month, and up 6.3% from November of the previous year.

The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed on This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Rahul and Smitha Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and Home Marketing Experts. You can reach Rahul and Smitha and their team online at: http://www.Morris-Homes.com, http://www.SRRealEstateGroup.com and http://www.TheTownhouseExpert.com

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Madison,Chester,Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown,Morris Plains,Morris Twp., Mountain Lakes, Parsippany,Randolph, Rockaway, Whippany.

Strongest Total Home Resales in 7 Years

According to a recent article from Reuters, the total resale numbers for 2013 have shown to be the strongest in 7 years. While some buyers are feeling the increase in interest rates this year, home sales ended on a stronger note in December and show some promise for 2014. From the original article:

Sales of existing homes rose slightly in December, as record low mortgage interest rates and pent-up demand helped push total sales last year to their highest in seven years.

The National Association of Realtors (NAR) said on Thursday that sales of previously owned homes rose 1 percent last month, to an annual rate of 4.87 million units. Total sales for 2013 were the strongest in seven years.

Economists polled by Reuters had expected home resales to rise to a 4.94 million-unit pace in December.

"For the year as a whole, it's a good recovery," NAR economist Lawrence Yun told reporters. "We lost some momentum toward the end of 2013."

Home resales have been hurt by a sharp rise in mortgage interest rates since the spring and price increases that have shut some home buyers out of the market.

But other recent indications of the sector's health have brightened as a steady rise in household formation from multi-decade lows props up demand and encourages builders to undertake new development projects.

Yun said two opposing forces are affecting the market: a mismatch of fast-rising prices coupled with weak income growth, which have combined to make home-buying less affordable for many Americans.

The median existing home price rose 9.9 percent in December to $198,000 from the same month in 2012.

Prices have risen mainly due to a shortage of properties on the market. The number of homes for sale remains relatively tight, and the inventory of unsold properties on the market dropped 9.3 from the prior month to 1.86 million.

Original article found here.

Rahul and Smitha Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and Home Marketing Experts. You can reach Rahul and Smitha and their team online at: http://www.Morris-Homes.com, http://www.SRRealEstateGroup.com and http://www.TheTownhouseExpert.com

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Madison,Chester,Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown,Morris Plains,Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany.

Subscribe to:

Posts (Atom)