| |

November 2012 Market Update

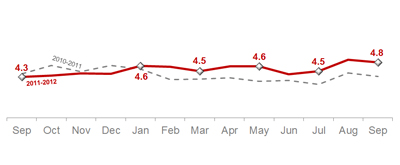

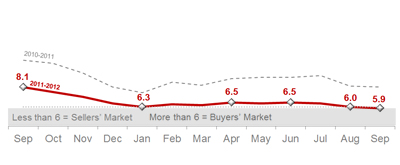

The national housing market is showing steady signs of recovery due to a combination of rising demand, declining inventory, and low interest rates. A good indicator that the market will experience a full-force recovery is strongly evidenced by the continual increase in median home prices. Usually, prices slow down after the peak summer sales season, but the current gains are a sign that the housing recovery is self-reinforcing. NAR Chief Economist Lawrence Yun states, “The market trend is up. Despite occasional month-to-month setbacks, we’re experiencing a genuine recovery. More people are attempting to buy homes than are able to qualify for mortgages, and recent price increases are not deterring buyer interest. Rather, inventory shortages are limiting sales.” Now is one of the most favorable times in market history to purchase a home due to record-low interest rates. With the uncertainty of the upcoming election and the likelihood that interest rates might not be low for much longer, the time to buy is now. Home Sales In MillionsHome sales fell 1.7% month-over-month to a seasonally adjusted rate of 4.75 millionunits, an 11% increase from last year. Distressed homes (which include short sales and foreclosures that traditionally sell for 15%–20% less on average compared to nondistressed homes) accounted for 24% of September sales, up from 22% of sales the previous month; they were 30% in September 2011. Although the number of distressed properties is decreasing from month to month, they are still high by historic standards.  Home Price In ThousandsHome prices have slightly decreased this month, with the current median home price at $183,900, down 1.7% from last month’s median price of $184,900, but up 11.3% from last year. While the month-to-month trend has seen a small dip, the year-over-year trend of increasing home prices is still present. September marks the seventh consecutive month of year-over-year price increases, the largest year-to-date rise since 2005. Inventory- Month's Supply In MonthsHousing inventory fell 3.3% from last month to 2.32 million existing homes available for sale, a 5.9-month supply. Listed inventory is down 20% from last year’s 8.1-month supply. NAR Chief Economist Lawrence Yun claims, “The shrinkage in housing supply is supporting ongoing price growth, a pattern that could accelerate unless home builders robustly ramp up production.” Regardless of the small decline in inventory, a 5.9-month supply still represents a fairly balanced housing market. Source: National Association of Realtors

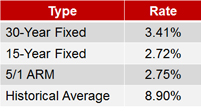

Interest Rates

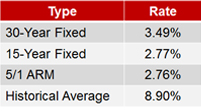

Mortgage rates this month continue to decline at or around 3.41%, reaching record lows. While these rates underline an extremely favorable time to buy, “some buyers who could easily afford a mortgage can’t assume they will get one,” states NAR President Moe Veissi. He advises home buyers “to be more focused on the mortgage process in the current environment where lenders and banking regulators are being risk adverse. Shopping for competitive mortgage terms is a good idea, but it may be more important to find a bank that is willing to work with you given your credit history.”

This Month's Video

|

Contact me,

your local real estate expert,

for information about what's going on in our area.

|

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

| |

What's happening in the Morris, Essex, Somerset and Union County New Jersey Real Estate Markets. North NJ Real Estate Specialists. Real Estate Sales and News in Morristown, Morris Twp, Denville, Parsippany, Montville, Hanover, East Hanover, Randolph, Mountain Lakes, Whippany, Madison, Chatham, Basking Ridge, Short Hills, Summit, New Providence, Livingston, Roseland and more.

Friday, November 16, 2012

November 2012-Market Update

Thursday, October 11, 2012

October 2012-Market Update

| |

October 2012 Market Update

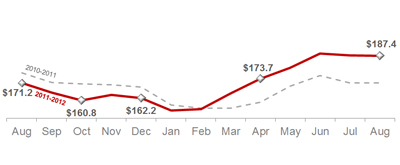

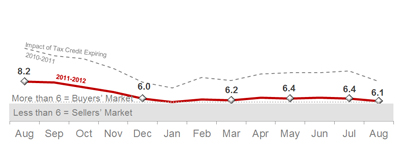

The national housing market continues to recover, indicated by consistent increases in both home sales and prices. Inventories in much of the United States are primarily balanced, which favors neither sellers nor buyers. However, large pockets of the country are experiencing inventory shortages, which puts pressure on prices. Many of the hardest-hit areas during the downturn now have some of the tightest inventories. The return of price appreciation and a stronger market, particularly in those locations, is a welcome signal of returning market health. “Some buyers are frustrated with mortgage availability. If most of the financially qualified buyers could obtain financing, sales would be about 10 to 15% stronger, and the related economic activity would create several hundred thousand jobs over the period of a year,” states NAR President Moe Veissi. Despite difficult mortgage qualifying conditions sidelining some buyers, others are still taking advantage of excellent housing affordability conditions, which is evidence of notable stored-up housing demand that accumulated since 2007. With the housing market coming close to a full recovery and mortgage rates hitting new record lows, the time to buy is now. Home Sales In MillionsHome sales this month rose 7.8% from last month to a seasonally adjusted rate of 4.82 million units, a 9.3% increase from last year. Distressed homes (which include short sales and foreclosures that traditionally sell for 15%–20% less on average compared to nondistressed homes) accounted for 22% of August sales, down from 25% of sales last month and 31% of sales last year. Although the amount of distressed properties is decreasing from month to month, they are still high by historic standards. Home Price In ThousandsHome prices continue to rise due to shrinking inventory and an increase in demand. The current median home price is $187,400, up 9.5% from a year ago and down just 0.2% from last month. This has been the sixth consecutive month of year-over-year price gains, the largest year-to-date rise since 2005. Inventory- Month's Supply In MonthsHousing inventory rose to 2.47 million homes available for sale—a 6.1-month supply—up 2.9% from last month and down 18.2% from last year’s 8.2-month supply. This marks the ninth consecutive month of inventory at a 6-month supply, a clear indicator of a balanced market and full-scale housing market recovery. Robust improvement in employment is the primary concern remaining, and as that improves the housing market recovery will be on firmer footing for the future. Source: National Association of Realtors

Interest Rates

Mortgage rates this month at or around 3.49% are back at record lows. The decline in the 30-year fixed rates is partially due to a result of the Federal Reserve’s announcement of “QE3.” QE3 is a new bond purchase plan which should help stimulate the ongoing housing recovery. Home buyer affordability remains high for home buyers who buy now while rates are low.

This Month's Video

|

Contact me,

your local real estate expert,

for information about what's going on in our area.

|

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate. | |

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station,Denville, East Hanover,Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains,Morris Twp., Mountain Lakes, Parsippany, Randolph,Rockaway, Whippany

Monday, August 13, 2012

August 2012-Market Update

The national housing market continues to recover, indicated by a balanced supply of inventory and increasing home prices across the country. NAR President Moe Veissi states, “The very favorable market conditions are helping to unleash a pent-up demand, which is why housing supplies have tightened and are supporting growth in home prices.”

However, rising demand has led to tight supplies of affordable homes for first-time home buyers, who now only represent 32% of purchasers. NAR Chief Economist Lawrence Yun claims “a healthy market share of first-time buyers would be about 40%, so these figures show that tight inventory in the lower price ranges, along with unnecessarily tight credit standards, are holding back entry-level activity.”

Regardless, with the market heating up and mortgage rates continuing to hit record-lows, now is one of the most favorable times in history to buy a home.

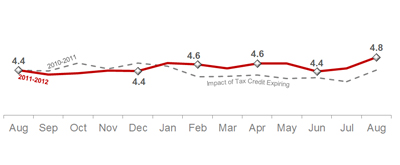

Home Sales

in millions

While home sales declined 5.4% from last month to 4.37 million units, year-over-year sales increased 4.5%. Distressed homes (which include short sales and foreclosures that traditionally sell for 15%–20% less on average compared to non distressed homes) allotted for 25% of June sales, which is unchanged from May, but is 30% below year-ago sales. However, despite the declining levels seen from past years, it is still expected that distressed property sales will still be largely present and higher than the historic average.

Home Price

in thousands

Shrinking inventory and a decline in distressed properties on the market continue to drive home prices up. The median home price rose 5% from last month, and 7.9% compared to a year earlier to $189,400. This is the fourth consecutive month of year-over-year price gains, which hasn’t been seen since February to May of 2006, a period of peak performance in the housing market.

Inventory- Month's Supply

in months

Housing inventory fell another 3.2% in June to a current 2.39 million homes available for sale, a 6.6-month supply. This marks the seventh consecutive month of inventory at a 6-month supply, the threshold for a balanced market, giving both buyers and sellers an equal advantage. Movement out of the three-year buyer’s market is imperative toward reaching a full-scale housing market recovery.

Source: National Association of Realtors

Interest RatesMortgage rates at or around 3.53% continue to drop and boost home affordability. These are some of the lowest rates on record since 1971, increasing the urgency to buy now.

This Month's Video

Topics For Home Owners, Buyers & Sellers

With many markets heating up, home prices are rising and inventory is shrinking. This high market activity puts sellers at a strong advantage, but to ensure that your property sells quickly and for the highest price, here are some tips to turn that “For Sale” sign into a “Sold” sign:

- List at market price. Even though the market is in your favor as a seller, incorrectly priced homes will not attract buyers. If you list your home at market price, your home will be on the market for fewer days, you are twice as likely to have multiple offers, and your chances of fewer price reductions and your sales price being close to your list price are much greater.

- Condition is key. Keeping your home in excellent condition includes enhancing your curb appeal by landscaping your front yard, as well as making necessary updates such as painting and roof repair. 93% of homes that were in better condition received offers close to their list price.

- Stage your home. Many buyers prefer to see a depersonalized home, devoid of the seller’s personal items, so that they can picture themselves in it. Staging can be as simple as rearranging furniture or uncluttering a room. The cost of it can be minimal compared to the benefits of more showings and, ultimately, a higher asking price.

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.

The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station,Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains,Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Friday, July 13, 2012

July 2012-Market Update

July 2012 Market Update

The national housing market continues to recover, evidenced by a balanced supply of inventory as well as improvements in home prices and the number of homes sold. The median home price increased again this month from last month, reaching $182,000 compared to $155,600 just three months ago, a 17.4% increase.

Recently, a growing trend facing certain regions is tremendous inventory shortages. NAR President Moe Veissi advises buyers in markets with limited supply who are seeing multiple bidding and competition between first-time buyers and cash investors that, “It’s extremely important [for buyers] to listen to the advice of your agent and perform all the due diligence that you would normally do in a more balanced market.”

With rental rates and buyers’ confidence on the rise due to record-low mortgage rates, the market is heating up, making now one of the most favorable times in history to buy a home.

Home Sales

in millions

While home sales declined 1.5% from last month to 4.55 million units, year-over-year increases are 9.6% higher. Lawrence Yun, NAR chief economist, states, “home sales have moved markedly higher with eleven consecutive months of gains over the same month a year earlier.”

Home Price

in thousands

Thanks to a decline in distressed properties on the market (which includes short sales and foreclosures that traditionally sell for 15%–20% less on average compared to non-distressed homes), the median home price rose 5.1% from last month, and 7.9% compared to a year earlier to $182,600. This is the third consecutive month of year-over-year price gains, which hasn’t been seen since March to May of 2006, a period of peak performance in the housing market.

Inventory- Month's Supply

in months

Housing inventory remained stable with a 6.6-month supply on the market, 20% below year-ago levels. This marks the sixth consecutive month of inventory at a 6-month supply, the threshold for a balanced market, giving both buyers and sellers an equal advantage. Movement out of the three-year buyer’s market is imperative toward reaching a full-scale housing market recovery.

Source: National Association of Realtors

Interest RatesMortgage rates around 3.66% continue to boost home affordability—some of the lowest rates on record since 1971. These rates may be as close to the bottom as they will get, adding to the urgency to buy a home now while these record lows hold.

This Month's Video

Topics For Home Owners, Buyers & Sellers

As many markets continue to heat up, both buyers and sellers are facing multiple offer situations. If you’re a buyer in a bidding war, here are some tips to give you an edge:

- Get pre-approved for your loan. Get pre-approved by a local lender and attach a copy to your offer.

- Think unevenly. An uneven offer price such as $251,000 instead of $250,000, will stand out from the others, and it may just beat an offer that came in at a slightly lower figure with an even bid.

- Be flexible. The fewer contingencies and the cleaner the offer, the better the chance you have to win a bidding war. Have your agent find out the seller’s ideal closing date, and offer to make it happen.

- Hide your hand. Determine the highest bid you’re trying to beat, and try to come in over that rather than offering the most you can afford.

- Don’t get distracted. If you find yourself caught up in the excitement of a bidding war, step back and reassess if the home has everything you want and need.

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.

The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station,Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains,Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Monday, June 11, 2012

June 2012-Market Update

Signs of recovery continue in the housing market, demonstrated by improvements in the number of homes sold and national home prices. For the first time since June 2011, the median home price has exceeded $175,000. Continued strength in economic indicators, employment, and consumer confidence could help to bring full recovery to the housing market. Relaxation in financial institution’s tight lending standards will also significantly help the recovery.

“With the tight lending environment it’s a good idea to consult with a Realtor about mortgages and program options in the area, and tips for boosting credit scores well in advance of making an offer on a home,” National Association of Realtors President Moe Veissi advises. “It helps to go into the process knowing what it takes to succeed.”

With rents on the rise, buying has become an increasingly attractive option due to home affordability, or the percentage income it takes to pay the mortgage, is the most favorable in market history. Current record interest rates, which factor into affordability, will not last forever, so buyers wanting to take advantage of this unique time in history will want to act before rates rise.

Home Sales

In Millions

Home sales increased 10% from a year ago to 4.62 million units, which is also up 3.4% from the previous month. A strengthening economy is improving consumer confidence and drawing an increasing number of people into the market. Some local markets are experiencing a shift back into a seller’s market, leading to a shortage of homes available for sale, multiple offers, and higher prices. As more markets follow suit, national home sales could continue to increase.

.

Home Price

In Thousands

Thanks to a decline in distressed properties (which includes short sales and foreclosures that traditionally sell for 15%–20% less on average compared to non-distressed homes), the median home price rose 10% year-over-year to $177,400. This is the first consecutive month-to-month increase in home prices since June and July of 2010. NAR Chief Economist Lawrence Yun said “For the year, we’re looking at a modest overall price gain of 1%–2%, with stronger improvements in 2013.”

Inventory- Month's Supply

In Months

Housing inventory increased to 6.6 months supply, which is 28% below year-ago levels. This marks the fifth consecutive month of inventory near a six-month supply, which is the threshold of a balanced market. It is also significantly below the previous three years, in which year-end month’s supply ranged from 8.2–9.5. This indicates movement out of this deeply entrenched buyer’s market and is an important step toward a full-scale housing market recovery.

Source: National Association of Realtors

Interest Rates

Mortgage rates continue to boost home affordability by remaining below 4%—some of the lowest rates on record since 1971. These rates may come as close to bottom as they can get, adding to the urgency to buy a home now while these record lows hold.

This Month's Video

Topics For Home Owners, Buyers & Sellers

Thinking about buying? Wondering what pushes others to jump off the fence and buy now? Here is some insight into the top 3 reasons that impact a buyer’s sense of urgency:

- Excellent Market Conditions. Interest rates are at record lows and home prices are bouncing along what experts believe to be the bottom – there has never been a more affordable time to buy a home. With some local markets slipping into a seller’s market and reports of more following, the chance to cash in on this historic time may be narrowing.

- Having the Freedom to Move. First time homebuyers often wait for their lease to expire, not realizing that buying sooner is an option. Repeat buyers wait to sell their house when leasing may be an option, giving them freedom to move up sooner.

- A Major Life Event. Often a major milestone or development spurs on the need to purchase at a specific time. Getting married and having children are two of the top events creating the need to buy now.

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.

The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station,Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Thursday, June 7, 2012

Fantastic Investment Opportunity!

We recently listed this beautiful townhome in Morristown, just minutes away from everything… Downtown Morristown’s boutique shopping, dining, and cultural events. A commuter’s dream, just a walk away from the train to NYC. Currently leased until 10/2013, it’s a great opportunity for investors to purchase in an in-demand area. Check out the details on our website and call us with any questions or to schedule a private viewing!

44 Ridgedale Avenue #7, Morristown Court

44 Ridgedale Avenue #7, Morristown Court

Wednesday, May 16, 2012

These rock-bottom prices and rates won’t last long!

Experts are predicting that these prices and rates are the lowest

it’s going to get and that both will soon be picking up. “Several

housing experts are predicting that this year will be the last chance

for bargain hunters to cash in on the best deals of the weak housing

market.” More details:

Many of the bank-owned properties currently coming out of the foreclosure pipeline are being snapped up by investors who are fixing them up and renting them out — often to those who were displaced by the foreclosure of their own home. That has helped to lift prices on foreclosed properties, according to Alex Villacorte, the director of analytics for Clear Capital, which specializes in housing market valuations.

"That could have a significant impact on the market overall in terms of providing a rising floor to home values," he said.

In some markets hit hard by foreclosures, the turnaround in prices is already underway. Phoenix recorded an 8.4% jump in home prices during the three months ended April 30, compared with the three months ended January 31, according to Clear Capital.

"It's crazy," said Tanya Marchiol, founder of Team Investments, a Phoenix real estate investing firm. "Stuff I was selling six months ago for $60,000 to $80,000 is now $90,000 to $110,000."

Miami saw a 4.6% increase quarter-over-quarter through April, and Tampa, Fla., was up 4.4%, according to Clear Capital.

Goodbye 3.8% mortgage. In addition to home prices, mortgages could also move higher.

Mortgage rates have been at or near historic lows for much of the past six months. The average interest rate for a 30-year, fixed-rate mortgage has not topped 4.5% since July 2011 and this week, it hit 3.84%, a new low.

But rates aren't expected to remain at these record-low levels much longer. As the economy continues to recover, rates will move higher, said Doug Lebda, CEO of LendingTree, the online lending site. Although, he said, they will "stay very reasonable."

The Mortgage Bankers Association is forecasting that the 30-year fixed will hit 4.5% by the end of the year.

Greater demand for loans will help fuel the increase, according to Lebda.

Even though mortgage rates have been cheap, borrowing for home purchases has been sluggish. The Mortgage Bankers Association estimates that homebuyers will take out mortgage loans totaling about $415 billion this year, an increase of less than 3% compared with 2011. Next year, however, it forecasts that amount will almost double to $706 billion.

What does this mean for you? It means if you are considering buying a property for you, your family, or as an investment or an upgrade, the market is offering you an opportunity for a fraction of the historic cost! This is an opportunity you don’t want to miss. Even if you hadn’t been considering purchasing a property or wanted to buy 5 years down the road, taking advantage of the market now may make the best sense for your situation.

If you’d like to find out more and see if buying (or selling) a property makes sense for you, please give us a call or e-mail! We’re happy to help you make the right choice!

You can read the original article from CNN Money here.

Many of the bank-owned properties currently coming out of the foreclosure pipeline are being snapped up by investors who are fixing them up and renting them out — often to those who were displaced by the foreclosure of their own home. That has helped to lift prices on foreclosed properties, according to Alex Villacorte, the director of analytics for Clear Capital, which specializes in housing market valuations.

"That could have a significant impact on the market overall in terms of providing a rising floor to home values," he said.

In some markets hit hard by foreclosures, the turnaround in prices is already underway. Phoenix recorded an 8.4% jump in home prices during the three months ended April 30, compared with the three months ended January 31, according to Clear Capital.

"It's crazy," said Tanya Marchiol, founder of Team Investments, a Phoenix real estate investing firm. "Stuff I was selling six months ago for $60,000 to $80,000 is now $90,000 to $110,000."

Miami saw a 4.6% increase quarter-over-quarter through April, and Tampa, Fla., was up 4.4%, according to Clear Capital.

Goodbye 3.8% mortgage. In addition to home prices, mortgages could also move higher.

Mortgage rates have been at or near historic lows for much of the past six months. The average interest rate for a 30-year, fixed-rate mortgage has not topped 4.5% since July 2011 and this week, it hit 3.84%, a new low.

But rates aren't expected to remain at these record-low levels much longer. As the economy continues to recover, rates will move higher, said Doug Lebda, CEO of LendingTree, the online lending site. Although, he said, they will "stay very reasonable."

The Mortgage Bankers Association is forecasting that the 30-year fixed will hit 4.5% by the end of the year.

Greater demand for loans will help fuel the increase, according to Lebda.

Even though mortgage rates have been cheap, borrowing for home purchases has been sluggish. The Mortgage Bankers Association estimates that homebuyers will take out mortgage loans totaling about $415 billion this year, an increase of less than 3% compared with 2011. Next year, however, it forecasts that amount will almost double to $706 billion.

What does this mean for you? It means if you are considering buying a property for you, your family, or as an investment or an upgrade, the market is offering you an opportunity for a fraction of the historic cost! This is an opportunity you don’t want to miss. Even if you hadn’t been considering purchasing a property or wanted to buy 5 years down the road, taking advantage of the market now may make the best sense for your situation.

If you’d like to find out more and see if buying (or selling) a property makes sense for you, please give us a call or e-mail! We’re happy to help you make the right choice!

You can read the original article from CNN Money here.

Wednesday, May 9, 2012

May 2012-Market Update

The housing market and the overall economy are improving at modest rates nationally, and in some areas they have actually gained momentum. The Conference Board’s CEO confidence index is up a notable 14 points—from 49 last quarter to a current reading of 63. A reading of 50 is the threshold above which indicates an optimistic outlook and below indicates pessimism. Rapidly growing optimism is a good sign for future hiring and growth.

“The recovery is happening, though not at a breakout pace, but we have seen nine consecutive months of year-over-year sales increases,” NAR Chief Economist Lawrence Yun said. “Existing-home sales are moving up and down in a fairly narrow range that is well above the level of activity during the first half of last year. With job growth, low interest rates, bargain home prices, and an improving economy, the pent-up demand is coming to market and we expect housing to be notably better this year.”

As rents continue to rise, buying becomes a more and more attractive option as home affordability, or the percent of income it takes to pay the mortgage, continues to be among the most favorable in history. The current record interest rates, which factor into affordability, cannot last forever—buyers wanting to take advantage of this unique time in history will want to act before rates rise.

Home Sales

In Millions

Home sales slipped 2.6% from the previous month to 4.48 million units, yet are 5.2% higher from a year ago. A strengthening economy is improving consumer confidence and drawing an increasing number of people into the market. In some local markets, there is not enough inventory of quality homes for buyers to purchase. As these markets see more new listings for their hungry buyers, national home sales could increase.

.

Home Price

In Thousands

Thanks to a decline in distressed properties, which sell for a 15%–20% less on average compared to non-distressed homes, the median home price rose 5.3% compared to the previous month and 2.6% compared to a year earlier to $163,800. This is the first time in 8 months that home prices have been up by over 1% month-to-month. NAR President Moe Veissi said, “In most areas over the long term, home prices have nowhere to go but up.”

Inventory- Month's Supply

In Months

Housing inventory remained stable from the previous month at 6.3 months supply and was 26% below year-ago levels. This marks the fourth consecutive month of inventory near a six-month supply, which is the threshold of a balanced market. Movement out of the deep buyer’s market that has persisted over the past three years is an important step that must precede a full-scale housing market recovery.

Source: National Association of Realtors

Interest Rates

Mortgage rates continue to boost home affordability by remaining below 4%—some of the lowest rates on record since 1971. These rates may have begun to find a bottom as there is not much more room to go down, adding to the urgency to buy a home now while these record lows hold.

This Month's Video

Topics For Home Owners, Buyers & Sellers

Pricing a listing at market value is a critical component to getting it sold. Here are a few of the advantages of pricing it right:

- Less Time on the Market. Homes that were priced at market value sold in half the number of days as homes that were overpriced.

- More Money. Pricing right when the home is first listed leads to sellers netting a higher percentage of their asking price, also referred to as the list-to-sell ratio.

- Less Hassle. When a home is priced right, it means that fewer buyers need to view the home to understand it is a good value—and that leads to fewer showings before getting an offer.

- Fewer Reductions. When a home is priced at market value, often it won’t need a price reduction. Depending on local market conditions, sometimes it will—either way, it will be less likely to require one if it is priced right to begin with.

- More Multiple Offers. Homes that are priced right are twice as likely to have multiple offers. This can lead to a higher sold price and it puts the seller in the driver’s seat by providing more options to choose from.

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.

The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Monday, May 7, 2012

These rock-bottom prices and rates won't last long!

Experts are predicting that these prices and rates are the lowest it’s going to get and that both will soon be picking up. “Several housing experts are predicting that this year will be the last chance for bargain hunters to cash in on the best deals of the weak housing market.” More details:

Many of the bank-owned properties currently coming out of the foreclosure pipeline are being snapped up by investors who are fixing them up and renting them out -- often to those who were displaced by the foreclosure of their own home. That has helped to lift prices on foreclosed properties, according to Alex Villacorte, the director of analytics for Clear Capital, which specializes in housing market valuations.

"That could have a significant impact on the market overall in terms of providing a rising floor to home values," he said.

In some markets hit hard by foreclosures, the turnaround in prices is already underway. Phoenix recorded an 8.4% jump in home prices during the three months ended April 30, compared with the three months ended January 31, according to Clear Capital.

"It's crazy," said Tanya Marchiol, founder of Team Investments, a Phoenix real estate investing firm. "Stuff I was selling six months ago for $60,000 to $80,000 is now $90,000 to $110,000."

Miami saw a 4.6% increase quarter-over-quarter through April, and Tampa, Fla., was up 4.4%, according to Clear Capital.

Goodbye 3.8% mortgage. In addition to home prices, mortgages could also move higher.

Mortgage rates have been at or near historic lows for much of the past six months. The average interest rate for a 30-year, fixed-rate mortgage has not topped 4.5% since July 2011 and this week, it hit 3.84%, a new low.

But rates aren't expected to remain at these record-low levels much longer. As the economy continues to recover, rates will move higher, said Doug Lebda, CEO of LendingTree, the online lending site. Although, he said, they will "stay very reasonable."

The Mortgage Bankers Association is forecasting that the 30-year fixed will hit 4.5% by the end of the year.

Greater demand for loans will help fuel the increase, according to Lebda.

Even though mortgage rates have been cheap, borrowing for home purchases has been sluggish. The Mortgage Bankers Association estimates that homebuyers will take out mortgage loans totaling about $415 billion this year, an increase of less than 3% compared with 2011. Next year, however, it forecasts that amount will almost double to $706 billion.

What does this mean for you? It means if you are considering buying a property for you, your family, or as an investment or an upgrade, the market is offering you an opportunity for a fraction of the historic cost! This is an opportunity you don’t want to miss. Even if you hadn’t been considering purchasing a property or wanted to buy 5 years down the road, taking advantage of the market now may make the best sense for your situation.

If you’d like to find out more and see if buying (or selling) a property makes sense for you, please give us a call or e-mail! We’re happy to help you make the right choice!

You can read the original article from CNN Money here.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Many of the bank-owned properties currently coming out of the foreclosure pipeline are being snapped up by investors who are fixing them up and renting them out -- often to those who were displaced by the foreclosure of their own home. That has helped to lift prices on foreclosed properties, according to Alex Villacorte, the director of analytics for Clear Capital, which specializes in housing market valuations.

"That could have a significant impact on the market overall in terms of providing a rising floor to home values," he said.

In some markets hit hard by foreclosures, the turnaround in prices is already underway. Phoenix recorded an 8.4% jump in home prices during the three months ended April 30, compared with the three months ended January 31, according to Clear Capital.

"It's crazy," said Tanya Marchiol, founder of Team Investments, a Phoenix real estate investing firm. "Stuff I was selling six months ago for $60,000 to $80,000 is now $90,000 to $110,000."

Miami saw a 4.6% increase quarter-over-quarter through April, and Tampa, Fla., was up 4.4%, according to Clear Capital.

Goodbye 3.8% mortgage. In addition to home prices, mortgages could also move higher.

Mortgage rates have been at or near historic lows for much of the past six months. The average interest rate for a 30-year, fixed-rate mortgage has not topped 4.5% since July 2011 and this week, it hit 3.84%, a new low.

But rates aren't expected to remain at these record-low levels much longer. As the economy continues to recover, rates will move higher, said Doug Lebda, CEO of LendingTree, the online lending site. Although, he said, they will "stay very reasonable."

The Mortgage Bankers Association is forecasting that the 30-year fixed will hit 4.5% by the end of the year.

Greater demand for loans will help fuel the increase, according to Lebda.

Even though mortgage rates have been cheap, borrowing for home purchases has been sluggish. The Mortgage Bankers Association estimates that homebuyers will take out mortgage loans totaling about $415 billion this year, an increase of less than 3% compared with 2011. Next year, however, it forecasts that amount will almost double to $706 billion.

What does this mean for you? It means if you are considering buying a property for you, your family, or as an investment or an upgrade, the market is offering you an opportunity for a fraction of the historic cost! This is an opportunity you don’t want to miss. Even if you hadn’t been considering purchasing a property or wanted to buy 5 years down the road, taking advantage of the market now may make the best sense for your situation.

If you’d like to find out more and see if buying (or selling) a property makes sense for you, please give us a call or e-mail! We’re happy to help you make the right choice!

You can read the original article from CNN Money here.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Foreclosure is Not the Only Option. Why a Short Sale can be a Better Option than a Foreclosure?

Headlines today are filled with stories about homeowners in financial

distress—people who face a lender’s foreclosure on their home.

Do You Owe More on your Mortgage than the House is Worth and Can't Afford the Payments? Foreclosure is Not the Only Option. You might be able to Sell it for Less than you Owe - Without Having to Pay the Lender the Difference.

Consider a Short Sale Instead. Here are the benefits compared to a Foreclosure:

Call Us Today at 973-953-7777 for a Confidential Consultation to see if you qualify for a Short Sale!

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Smitha and Rahul and their team specialize in North-Central New Jersey and all Morris County Towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Do You Owe More on your Mortgage than the House is Worth and Can't Afford the Payments? Foreclosure is Not the Only Option. You might be able to Sell it for Less than you Owe - Without Having to Pay the Lender the Difference.

Consider a Short Sale Instead. Here are the benefits compared to a Foreclosure:

- We will List and Sell Your House.

- The Lender Will Pay the Realtor Fee.

- And You Get to Protect Your Credit Score.

Call Us Today at 973-953-7777 for a Confidential Consultation to see if you qualify for a Short Sale!

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Smitha and Rahul and their team specialize in North-Central New Jersey and all Morris County Towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Tuesday, April 17, 2012

April 2012-Market Update

Now three months into 2012, both the housing market and the overall economy are improving at modest rates. These improvements have inspired confidence in consumers, demonstrated by a 9.2% increase in pending home sales in February from the year prior.

Both home prices and sales are expected to increase in 2012. Lawrence Yun, chief economist for NAR, stated, “Falling visible and shadow inventory [bank-held properties], combined with a dearth of new-home and apartment construction during the past three years, assure that rents will continue to rise, with likely home price increases in 2012.”

As rents continue to rise, buying becomes a more and more attractive option as home affordability, or the percent of income it takes to pay the mortgage, continues to be among the most favorable in history. Trulia’s Winter 2012 Buy vs. Rent Index, which measures the relative cost of renting compared to asking prices of homes found that in 98% major metropolitan areas sampled, it was more affordable to buy than to rent.

Home Sales

In Millions

Home sales dipped 0.9% in February to 4.59 million units, yet are 8.8% higher from a year ago. A strengthening economy is improving consumer confidence with an increasing amount of people in the market. Additionally, as the market shows signs of improvement, more people are feeling the urgency to buy while prices and interest rates are still at some of the most affordable levels in history.

.

Home Price

In Thousands

After slipping a bit at the beginning of the year, median home prices rose to $156,600, up 0.3% from a year ago. NAR President Moe Veissi said, “People realize that home ownership is an investment in their future. Given an apparent overcorrection [dropping prices as an overreaction to market conditions] in most areas, over the long term home prices have nowhere to go but up.”

Inventory- Month's Supply

In Months

Housing inventory rose 4.3% in February to 2.43 million homes, representing a 6.4-month supply, up from 6.0 in January. There are several factors driving this increase in the inventory of homes. First, banks have settled major lawsuits regarding fraudulent foreclosure practices with state governments, which has enabled them to start moving many foreclosures off their balance sheets and into the market. Pending sales are up, and home building is starting to show signs of life again after three years of low new-housing construction.

Source: National Association of Realtors

Interest Rates30-year fixed mortgages continued to improve home affordability by dropping to 3.89% in February, the lowest on record since 1971. Indications are that these rates may have begun to find a bottom as well, as they have shown rising levels in Freddie Mac’s weekly index, adding to the urgency to buy a home now while these rates continue at record lows.

This Month's Video

Topics For Home Owners, Buyers & Sellers

Home buying is often exciting, but packing up and moving is almost always stressful. Below are a few tips to help make the move a smooth one.

- Special Boxes for Special Items. Dish barrels help protect dishware, and long flat boxes help protect artwork. Wardrobe boxes, which have a metal bar to hang clothes on, can simplify and speed up packing your closet.

- Paper, the Secret Weapon. Packing paper, or unprinted newsprint, can be used several different ways. Use it to protect fragile items or crunch it up to use as padding. Remember, ink on regular newspaper can rub off and stain. Use Bubble Wrap for extra- delicate items.

- Tape It Securely. Masking and duct tape don’t stick to cardboard as well as brown packing tape.

- Tape It Quickly. Tape guns help you assemble boxes faster.

- Mark It Clearly. Clearly label boxes. Marking the sides instead of the top is best as the tops are covered when boxes are stacked.

- Protect the Big Items. Protect furniture with pads and put mattresses in plastic bags to prevent damage during the trip.

- Lighten the Load. The help of a dolly or handcart can save your back and speed up the moving process.

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.

The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Monday, March 26, 2012

Home buying much cheaper than renting according to CNN Money

The answer has never been clearer: Buy.

In 98 of the top 100 housing markets, buying a home is more affordable than renting, according to the online real estate company Trulia. Only Honolulu and San Francisco buck the trend.

There are several reasons. Home prices are falling. Mortgage interest rates are at historically low levels. And rents are on the rise.

Of course, many renters are not in a position to buy. For one, it's hard to get a mortgage these days, despite low rates. And paying rent can push them further away from being able to afford to buy.

"Rising rents make it harder for people to save for a down payment, which is the biggest barrier to buying a home that aspiring homeowners face," Jed Kolko, Trulia's chief economist.

The nation's cheapest buyer's market is Detroit, where purchasing is only 3.7 times more expensive than renting.

Other top five metro areas where buying is much better than renting are Oklahoma City, Dayton, Ohio,Warren, Mich. and Toledo, Ohio.

The size of the home can also make a difference. In some markets, renting can be a better deal on larger homes, according to Trulia.

"People will pay more for a home if they expect prices to rise and give them a better return on their investment," said Kolko.

Those calculations are about to change, according to Ken H. Johnson, a professor of real estate at Florida International who has studied the buy-vs-rent question extensively. He believes home prices nationally have bottomed.

"The ship has turned," he said. "Markets should slowly start to recover. Housing will return to its traditional role of a safety investment."

If so, that adds an incentive to buy. And investing in many of the most expensive markets may be even safer.

"Buying is much cheaper than renting in slow-growing places with high vacancy rates and land to spare, like Detroit and Cleveland, where prices are unlikely to improve much in the future," he said.

Original article found here.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

In 98 of the top 100 housing markets, buying a home is more affordable than renting, according to the online real estate company Trulia. Only Honolulu and San Francisco buck the trend.

There are several reasons. Home prices are falling. Mortgage interest rates are at historically low levels. And rents are on the rise.

Of course, many renters are not in a position to buy. For one, it's hard to get a mortgage these days, despite low rates. And paying rent can push them further away from being able to afford to buy.

"Rising rents make it harder for people to save for a down payment, which is the biggest barrier to buying a home that aspiring homeowners face," Jed Kolko, Trulia's chief economist.

The nation's cheapest buyer's market is Detroit, where purchasing is only 3.7 times more expensive than renting.

Other top five metro areas where buying is much better than renting are Oklahoma City, Dayton, Ohio,Warren, Mich. and Toledo, Ohio.

Rankings like these, however, can obscure the factors that go into each decision.

Housing markets, even within a single metro area, typically have local submarkets. Take New York City, for example. Renting in Manhattan is more affordable than buying. But in suburban Westchester County just miles to the north, buying is the more affordable option.The size of the home can also make a difference. In some markets, renting can be a better deal on larger homes, according to Trulia.

In San Francisco, for example, studio and one-bedroom apartments sell for 13.1 times rent, while three bedrooms or larger sell for more than 18 times rent.

The Trulia survey does not take into account home price trends, which are another factor for individuals choosing whether to buy or rent."People will pay more for a home if they expect prices to rise and give them a better return on their investment," said Kolko.

Those calculations are about to change, according to Ken H. Johnson, a professor of real estate at Florida International who has studied the buy-vs-rent question extensively. He believes home prices nationally have bottomed.

"The ship has turned," he said. "Markets should slowly start to recover. Housing will return to its traditional role of a safety investment."

If so, that adds an incentive to buy. And investing in many of the most expensive markets may be even safer.

Kolko pointed out that places like Honolulu, San Francisco and Boston have strong long-term growth prospects. They also have little physical space to grow, a factor that tends to keep prices strong.

On the other hand, old areas that aren't growing much -- while cheap -- may not return much in the long run."Buying is much cheaper than renting in slow-growing places with high vacancy rates and land to spare, like Detroit and Cleveland, where prices are unlikely to improve much in the future," he said.

Original article found here.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Tuesday, March 20, 2012

Warren Buffett: "I'd Buy Up 'A Couple Hundred Thousand' Single-Family Homes If I Could"

Some interesting housing comments from Berkshire Hathaway’s Warren Buffet:

Warren Buffett says along with equities, single-family homes are a very attractive investment right now.

Appearing live on CNBC's Squawk Box, Buffett tells Becky Quick he'd buy up "a couple hundred thousand" single family homes if it were practical to do so.

If held for a long period of time and purchased at low rates, Buffett says houses are even better than stocks. He advises buyers to take out a 30-year mortgage and refinance if rates go down.

Encouraging words, Mr. Buffet! With interest rates steadily at an all time low, you really can’t afford to miss the opportunity to buy your dream home, or if you’ve already found it, the chance to invest in real estate. One property, two properties, or more! Lending is tight, but it’s a real possibility that investors will see some great long term returns on purchases!

Call us today to for more information!

You find the original article by Alex Crippen here.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Warren Buffett says along with equities, single-family homes are a very attractive investment right now.

Appearing live on CNBC's Squawk Box, Buffett tells Becky Quick he'd buy up "a couple hundred thousand" single family homes if it were practical to do so.

If held for a long period of time and purchased at low rates, Buffett says houses are even better than stocks. He advises buyers to take out a 30-year mortgage and refinance if rates go down.

Encouraging words, Mr. Buffet! With interest rates steadily at an all time low, you really can’t afford to miss the opportunity to buy your dream home, or if you’ve already found it, the chance to invest in real estate. One property, two properties, or more! Lending is tight, but it’s a real possibility that investors will see some great long term returns on purchases!

Call us today to for more information!

You find the original article by Alex Crippen here.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Friday, March 9, 2012

March 2012-Market Update

Opportunities in the housing market continue to grow for buyers and sellers. Home affordability, driven mostly by record low interest rates, is among the lowest it has ever been. According to the National Association of Realtors, and based on national averages, the payments on a home today represent 12.8% of the median household income. This is both a good sign for those looking to purchase a home, and for the economy overall as consumers are keeping more money in their pockets.

If you’re a seller, the housing market shows signs of transitioning from a buyers’ market more of a balanced one. This means that home owners should start to see prices stabilize and begin to grow, presenting more favorable opportunities for those looking to sell their homes. In regards to the number of homes on the market, a key indicator of the health of the housing market, Lawrence Yun, NAR chief economist, said, “The broad inventory condition can be described as moving into a rough balance, not favoring buyers or sellers.”

With continuing job creation, the improving housing sector, and signs that the banks are beginning to lend more, 2012 looks to offer promising opportunities to both those looking to buy or sell a home.

Home Sales

.

Home Price

Inventory- Month's Supply

Interest Rates

The most powerful indicator of home affordability, interest rates on mortgage loans, were down again in January. The national average for a 30-year fixed mortgage was 3.92%, down 0.04% from the month before, and down nearly an entire percentage point (0.84%) from a year ago. These historically low rates, coupled with today’s home prices, represent an incredible opportunity for home buyers.

This Month's Video

Topics For Home Owners, Buyers & Sellers

Preparing your home for sale can seem daunting, but these tips will help you get the best price in the least amount of time.

1. Organizing and cleaning are crucial when prepping a home for sale. Potential homebuyers have a more positive reaction to a home that is clutter-free and that gives them the feeling it is “move-in ready.”

2. Determine replacement estimates before listing your home, even if you are not planning on making the replacements yourself. This information can help buyers make informed decisions.

3. Have your warranties ready—especially for home appliances that will stay with the home after the sale.

4. Curb appeal is a crucial factor because it determines first impressions. A poor first impression can cloud their entire opinion about the home.

Contact me,your local real estate expert, for information about what's going on in our area.

Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

If you’re a seller, the housing market shows signs of transitioning from a buyers’ market more of a balanced one. This means that home owners should start to see prices stabilize and begin to grow, presenting more favorable opportunities for those looking to sell their homes. In regards to the number of homes on the market, a key indicator of the health of the housing market, Lawrence Yun, NAR chief economist, said, “The broad inventory condition can be described as moving into a rough balance, not favoring buyers or sellers.”

With continuing job creation, the improving housing sector, and signs that the banks are beginning to lend more, 2012 looks to offer promising opportunities to both those looking to buy or sell a home.

Home Sales

in millions

Home sales were up 4.3% in January from December 2011 to 4.57 million (seasonally adjusted), and this is up from 0.7% from the year before. The steady increase in home sales over the last few months is positive encouragement for a continued housing recovery. Lawrence Yun said, “The uptrend in home sales is in line with all of the underlying fundamentals– pent-up household formation [lack of new home construction], record-low mortgage interest rates, bargain home prices, sustained job creation, and rising rents.”

.

Home Price

in thousands

Adding to home affordability in January, the median home price was down 2% from a year ago, to $154,700. While prices are still declining, foreclosed and other distressed properties, which have been putting downward pressure on home prices, are being moved more efficiently off the market, and default rates on home mortgage payments for the past three years are among the lowest in history.

Inventory- Month's Supply

in months

As sales increase with a growing demand for homes, the inventory of properties for sale fell 0.4% to 2.31 million, or a 6.1-month supply at the current sales level. This is down from a 6.4-month supply in December 2011. Historically, a 6-month supply has meant that the housing sector is balanced–favoring neither buyers’ nor sellers’.

Source: National Association of Realtors

Interest Rates

The most powerful indicator of home affordability, interest rates on mortgage loans, were down again in January. The national average for a 30-year fixed mortgage was 3.92%, down 0.04% from the month before, and down nearly an entire percentage point (0.84%) from a year ago. These historically low rates, coupled with today’s home prices, represent an incredible opportunity for home buyers.

This Month's Video

Topics For Home Owners, Buyers & Sellers

Preparing your home for sale can seem daunting, but these tips will help you get the best price in the least amount of time.

1. Organizing and cleaning are crucial when prepping a home for sale. Potential homebuyers have a more positive reaction to a home that is clutter-free and that gives them the feeling it is “move-in ready.”

2. Determine replacement estimates before listing your home, even if you are not planning on making the replacements yourself. This information can help buyers make informed decisions.

3. Have your warranties ready—especially for home appliances that will stay with the home after the sale.

4. Curb appeal is a crucial factor because it determines first impressions. A poor first impression can cloud their entire opinion about the home.

Contact me,your local real estate expert, for information about what's going on in our area.

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.

The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.Their team specialize in North Central New Jersey including towns such as Boonton, Chatham, Chester, Convent Station, Denville, East Hanover, Florham Park, Hanover, Harding Twp., Mendham, Montville, Morristown, Morris Plains, Morris Twp., Mountain Lakes, Parsippany, Randolph, Rockaway, Whippany

Subscribe to:

Posts (Atom)