| |

November 2012 Market Update

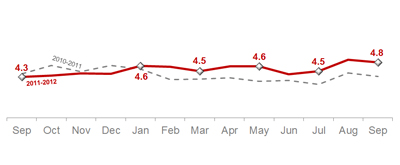

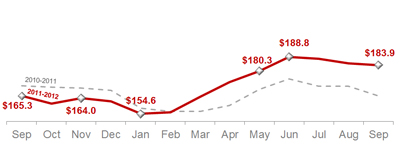

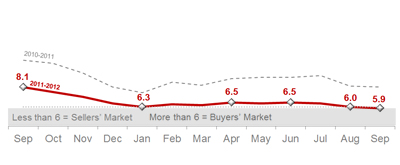

The national housing market is showing steady signs of recovery due to a combination of rising demand, declining inventory, and low interest rates. A good indicator that the market will experience a full-force recovery is strongly evidenced by the continual increase in median home prices. Usually, prices slow down after the peak summer sales season, but the current gains are a sign that the housing recovery is self-reinforcing. NAR Chief Economist Lawrence Yun states, “The market trend is up. Despite occasional month-to-month setbacks, we’re experiencing a genuine recovery. More people are attempting to buy homes than are able to qualify for mortgages, and recent price increases are not deterring buyer interest. Rather, inventory shortages are limiting sales.” Now is one of the most favorable times in market history to purchase a home due to record-low interest rates. With the uncertainty of the upcoming election and the likelihood that interest rates might not be low for much longer, the time to buy is now. Home Sales In MillionsHome sales fell 1.7% month-over-month to a seasonally adjusted rate of 4.75 millionunits, an 11% increase from last year. Distressed homes (which include short sales and foreclosures that traditionally sell for 15%–20% less on average compared to nondistressed homes) accounted for 24% of September sales, up from 22% of sales the previous month; they were 30% in September 2011. Although the number of distressed properties is decreasing from month to month, they are still high by historic standards.  Home Price In ThousandsHome prices have slightly decreased this month, with the current median home price at $183,900, down 1.7% from last month’s median price of $184,900, but up 11.3% from last year. While the month-to-month trend has seen a small dip, the year-over-year trend of increasing home prices is still present. September marks the seventh consecutive month of year-over-year price increases, the largest year-to-date rise since 2005. Inventory- Month's Supply In MonthsHousing inventory fell 3.3% from last month to 2.32 million existing homes available for sale, a 5.9-month supply. Listed inventory is down 20% from last year’s 8.1-month supply. NAR Chief Economist Lawrence Yun claims, “The shrinkage in housing supply is supporting ongoing price growth, a pattern that could accelerate unless home builders robustly ramp up production.” Regardless of the small decline in inventory, a 5.9-month supply still represents a fairly balanced housing market. Source: National Association of Realtors

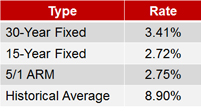

Interest Rates

Mortgage rates this month continue to decline at or around 3.41%, reaching record lows. While these rates underline an extremely favorable time to buy, “some buyers who could easily afford a mortgage can’t assume they will get one,” states NAR President Moe Veissi. He advises home buyers “to be more focused on the mortgage process in the current environment where lenders and banking regulators are being risk adverse. Shopping for competitive mortgage terms is a good idea, but it may be more important to find a bank that is willing to work with you given your credit history.”

This Month's Video

|

Contact me,

your local real estate expert,

for information about what's going on in our area.

|

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report.The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

Smitha and Rahul Ramchandani are a licensed real estate Broker-Salesperson/Sales Representative Team with Keller Williams in New Jersey. They are Buyer Specialists and a Home Marketing Experts. You can reach Smitha and Rahul and their team online at: http://www.Morris-Homes.com.

| |

What's happening in the Morris, Essex, Somerset and Union County New Jersey Real Estate Markets. North NJ Real Estate Specialists. Real Estate Sales and News in Morristown, Morris Twp, Denville, Parsippany, Montville, Hanover, East Hanover, Randolph, Mountain Lakes, Whippany, Madison, Chatham, Basking Ridge, Short Hills, Summit, New Providence, Livingston, Roseland and more.

Friday, November 16, 2012

November 2012-Market Update

Subscribe to:

Posts (Atom)